Driving without valid proof of insurance can lead to fines, license suspension, and vehicle impoundment in South Carolina. While the state requires all drivers to carry current insurance documentation in the vehicle at all times, many motorists still have questions about specifics. A South Carolina car accident lawyer can help you if you face charges for missing insurance.

Is Proof of Insurance Required in Your Vehicle?

In South Carolina, state law requires all motor vehicle owners to carry valid proof of liability insurance in their vehicles at all times. Drivers must be prepared to show evidence of insurance coverage in the event a law enforcement officer requests it during a traffic stop or accident investigation. Failure to provide current proof of insurance could result in fines or even impoundment of your vehicle.

The state sets minimum liability coverage requirements, which all motor vehicle insurance policies must meet. Liability coverage helps pay for damages or injuries you may cause to other drivers, passengers, pedestrians, or property with your vehicle. Having insurance coverage protects you financially while also demonstrating that you are a responsible driver who follows the law.

If you cannot show proof of valid auto insurance during a traffic stop, the officer may issue you a ticket. You will then need to provide evidence of coverage to the court by your hearing date to avoid being assessed fines, fees, or other penalties. The officer also has the discretion to have your vehicle impounded on the spot if you cannot produce proof of insurance.

What Is Considered Valid Proof of Insurance?

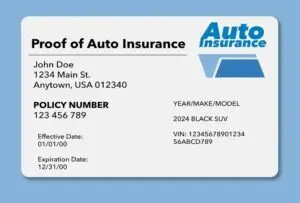

When asked to provide proof of insurance, you must be able to furnish valid documentation demonstrating current coverage. Typically, the officer will request that your insurance card showing policy details be issued directly by your provider. An electronic copy displayed on your smartphone or other device may also qualify as acceptable evidence.

Your insurance card displays important information, including the policy number, insurance company name, policyholder names, covered vehicle(s), effective date, and expiration date. As long as your coverage is valid on the date you get pulled over or have an accident, the insurance card should satisfy the legal requirement for proof. However, expired insurance cards do not meet the proof obligations under South Carolina law.

If you have recently switched insurance carriers, acquired a new policy, or renewed existing coverage but do not yet have the new documentation, additional evidence may substantiate your compliance. Contacting your insurance agent or company to email confirmation of your active policy to law enforcement could protect you from penalties in such a situation. Additionally, keeping a digital copy of your insurance policy on your mobile device or in your email could serve as a quick and convenient way to provide proof of insurance if needed.

What Happens if You Don’t Carry Proof in Your Car?

If you fail to carry a valid proof of insurance in your vehicle as required, you could face fines, license/registration suspension, and even vehicle impoundment if pulled over. Initially, the officer will likely issue you a ticket carrying a fine between $100 or more for a first offense. You will have to appear in court on the set date to provide evidence of coverage.

If you cannot furnish proof of continuous liability insurance by your court hearing, the penalties intensify. The court will likely suspend your driver’s license and vehicle registration for a set duration ranging from 30 days up to a year. You will also need to file an SR-22 certificate and pay a reinstatement fee to regain your driving and registration privileges.

Beyond the fines, court fees, suspensions, and SR-22 requirements, a further consequence could be the impoundment of your car. If a law enforcement officer cannot verify insurance coverage when you get pulled over, they have the option to impound your vehicle immediately on the spot. You would then need to cover towing and storage costs to reclaim your impounded vehicle after securing proper insurance.

Can You Show Proof of Insurance on Your Phone?

South Carolina allows drivers to show proof of insurance electronically on a smartphone or other device. As long as the document is easily accessible and displays all required coverage details, a mobile version is legally valid proof. Law enforcement officers routinely encounter electronic insurance cards during traffic stops.

An increasing number of insurance companies and independent apps enable policyholders to access digital insurance cards on demand. Features like auto-sync mean your mobile card updates automatically if you change vehicles or policies. Storing your card on your phone eliminates digging through glove boxes if pulled over while driving.

While mobile proof of insurance is permitted in South Carolina, you want to take care that your phone does not die, end up with technical issues, or lack cellular service. The officer still has the discretion to write you a ticket if they cannot clearly verify your active insurance details on the device itself during the stop. Keeping a physical card handy as a backup is wise as well.

When Policy Details Can Substitute Proof

If you do not have your insurance card or mobile proof available during a traffic stop, providing your precise policy details could potentially serve as adequate substitute proof of coverage. As long as you can furnish the active insurance company name, policyholder names, policy number, and effective dates verbally or in writing at the scene, this shows you likely hold a legitimate policy. However, it’s important to remember that while this may help at the moment, it’s always best to have your actual proof of insurance readily available to avoid any potential complications or misunderstandings with law enforcement.

However, the accepting officer would still have to take your word at the moment and later verify coverage through their own system checks. Without seeing the actual documentation, most officers may remain skeptical and still issue a ticket for failure to prove insurance. The burden falls back on you to produce real documentation before your court date to avoid actual penalties.

In limited situations, such as immediately after purchasing a new policy or switching providers, coverage details may be truly all you have. Providing every data point possible and contacting your agent and company to email the officer confirmation of active insurance offers your best chance at avoiding charges. But having the insurance card itself or mobile proof remains far more reliable.

Work with a South Carolina Car Accident Attorney

If you find yourself accused of not having your insurance on hand and now are facing charges, a lawyer may be able to help. If you have evidence that you were told you could supply it later or had it available on your phone or in some similar scenario, it is important to know that you have rights. Contact our team at Shelly Leeke Law Firm for a free consultation to see how and if we can help.